Here’s my latest analysis in Berlin Policy Journal (German Council on Foreign Relations -DGAP).Pipe Dream? The Nord Stream 2 pipeline project is in danger of being derailed.

Here’s my latest analysis in Berlin Policy Journal (German Council on Foreign Relations -DGAP).Pipe Dream? The Nord Stream 2 pipeline project is in danger of being derailed.

A pipeline project to double Gazprom’s export capacity to Europe has always been controversial. A recent ruling by Poland’s competition authority could seriously undercut the support it has accrued, leaving its European backers at odds.

The proposed Nord Stream 2 pipeline project has bitterly pitted European states that back the project, including Germany, the Netherlands, Austria, and France, against project opponents, including Ukraine, Poland, and other former Soviet-bloc states. The project aims to double the capacity of the existing huge, 55-billion-cubic-meter-per-year Nord Stream 1 pipeline, running in parallel to it under the Baltic Sea from near St. Petersburg in Russia directly to Greifswald in Germany.

This dispute has exposed two very different views of Gazprom, Russia’s state-owned gas-export monopoly, and of Vladimir Putin’s Russia itself – one side sees it as a “necessary” and “reliable” energy supplier, the other a dangerous and manipulative adversary. This dispute is but one more collision inflicting lasting harm on the European Project.

Polish competition authority rejects project

The latest row involves a ruling in late July by the Polish Office of Competition and Consumer Protection (Urzed Ochrony Konkurencji i Konsumentow, or UOKiK) rejecting an application by five private western European energy firms proposing to partner with Gazprom to build and operate Nord Stream 2. The firms are Germany’s E.ON (soon to be Uniper) and Wintershall, Austria’s OMV, Anglo-Dutch Shell, and France’s Engie.

Shortly before the Polish announcement, the five companies agreed to withdraw their association proposal to avoid UOKiK initiating a legal process against them. The commission’s president, Marek Niechcial, declared categorically on August 12 that the Polish rejection was definitive, asserting “This will stop the [Nord Stream 2] deal.” The five firms have nevertheless made it clear they are seeking a strategy to work around the decision, and expect to proceed as planned. Gazprom has said the same.

So why go through this proceeding in the first place? To understand these events better, I spoke with several experts and diplomats working on these matters in Moscow, Berlin, Washington, Paris, and Warsaw.

Commercial Arguments

An often-heard line of argument is that at least some of the five companies might actually have little commercial interest in the project, but need to preserve their relationships in Russia where they have large investments in energy projects. After all, the Kremlin has a track record of taking over projects from foreign partners with whom it has fallen out. A further theme in this vein is that Nord Stream 2 is not really needed in northwestern Europe, even though the Groningen field in the Netherlands and Norway’s reserves in the North Sea are declining, because future demand in northwestern Europe is overestimated and Liquefied Natural Gas (LNG) will be available from the United States. This view led to press speculation that the five firms likely welcomed the Polish decision, allowing them a graceful exit.

However, virtually all the experts I spoke with had no doubt Nord Stream 2 would be a lucrative commercial enterprise over the long run, and that the five firms seem genuinely enthusiastic. Continue reading →

Aquí abajo se puedan ver la grabación de la tortulia del 15 de agosto entre dos expertos y yo en el programa “El Fondo” de la red alemana de Deutschewelle (DE.de TV) sobre “la lucha entre aliados” de los EE. UU. y Alemania en la que Washington ha amenazado con fuertes sanciones contra su aliado de la OTAN, Berlín, por su participación en el proyecto del gasoducto ¨Nord Stream 2¨ con Rusia. Gracias a DW y su moderadora venezolana Silvia Cabrera.

Aquí abajo se puedan ver la grabación de la tortulia del 15 de agosto entre dos expertos y yo en el programa “El Fondo” de la red alemana de Deutschewelle (DE.de TV) sobre “la lucha entre aliados” de los EE. UU. y Alemania en la que Washington ha amenazado con fuertes sanciones contra su aliado de la OTAN, Berlín, por su participación en el proyecto del gasoducto ¨Nord Stream 2¨ con Rusia. Gracias a DW y su moderadora venezolana Silvia Cabrera.

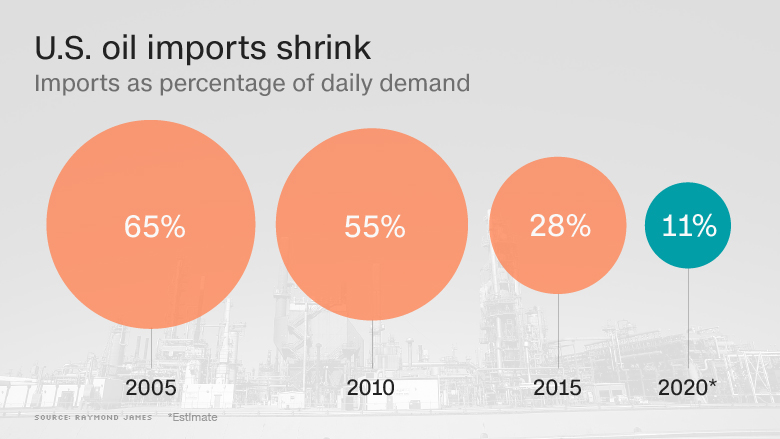

Contrary to his campaign hype (see article below), Trump-as-president will not do anything to interfere with the free flow of oil or gas to or from the USA. As I pointed out in the Investors Business Daily interview (Gillian Rich’s story is below), people central to Trump’s administration – such as Rex Tillerson, his designated secretary of state and former CEO of Exxon, and Harold Hamm, Trump’s fracking billionaire friend he wanted for secretary of energy – are global-market-oriented businessmen who would never agree to disconnect the USA from global energy markets.

Contrary to his campaign hype (see article below), Trump-as-president will not do anything to interfere with the free flow of oil or gas to or from the USA. As I pointed out in the Investors Business Daily interview (Gillian Rich’s story is below), people central to Trump’s administration – such as Rex Tillerson, his designated secretary of state and former CEO of Exxon, and Harold Hamm, Trump’s fracking billionaire friend he wanted for secretary of energy – are global-market-oriented businessmen who would never agree to disconnect the USA from global energy markets.

00

00 Here`s my latest at Berlin Policy Journal: about OPEC`s 30 Novermber meeting, US shale and the geopolitics from the Trump Administration towards Iran and the Saudis. – Tom O`D.

Here`s my latest at Berlin Policy Journal: about OPEC`s 30 Novermber meeting, US shale and the geopolitics from the Trump Administration towards Iran and the Saudis. – Tom O`D. Here’s my latest analysis in Berlin Policy Journal (German Council on Foreign Relations -DGAP).Pipe Dream? The Nord Stream 2 pipeline project is in danger of being derailed.

Here’s my latest analysis in Berlin Policy Journal (German Council on Foreign Relations -DGAP).Pipe Dream? The Nord Stream 2 pipeline project is in danger of being derailed.