A new USA-Ukrainian strategy has replaced the failed Russian oil-price cap. Oil is the material basis of Moscow’s capacity not only to fight Ukraine, but for its subversion in former USSR states, in Africa, Latin America and elsewhere. In the US, one finds strong bipartisan sentiment that “Russia is a gas station, masquerading as a state,” as former-Senator John McCain famously remarked, and that Moscow must be deprived of its easy petrosate riches.

My study for European Initiative for Energy Security (EIES, based in Brussels, is associated with SAFE in Washington, DC, though policy-independent), traces the new USA-Ukrainian joint war on Russian oil, which includes sanctions, tariffs; drone strikes on Russian refineries, ports and oil tankers, and seizures of shadow fleet ships at sea. All these are part of a coherent campaign begun in Spring 2025, as the Trump administration realized that its focus on offering Putin economic enticements to end the war was proving ineffective. It became clear that the application of “pain”, as Trump put it, would be necessary.

The present study shows, in some technical detail, how it is possible to, first, physically stop the majority of Russian seaborn oil exports, secondly, that this can force the shutdown of old, delicate W. Siberian oil fields in winter resulting in the permanent or semi-permanent ruin of these fields, the material basis of the Russian petrostate economy.

This, in fact, is the real threat, the “pain”, which Putin has begun to fear, inducing him to engage for the first time a bit more seriously in negotiations.

The Report also draws attention to and analyses the unfortunate incapacity of many European expert observers and think tanks to see the outlines of this coherent oil war strategy, distracted by the considerable bluster and threats employed by President Trump.

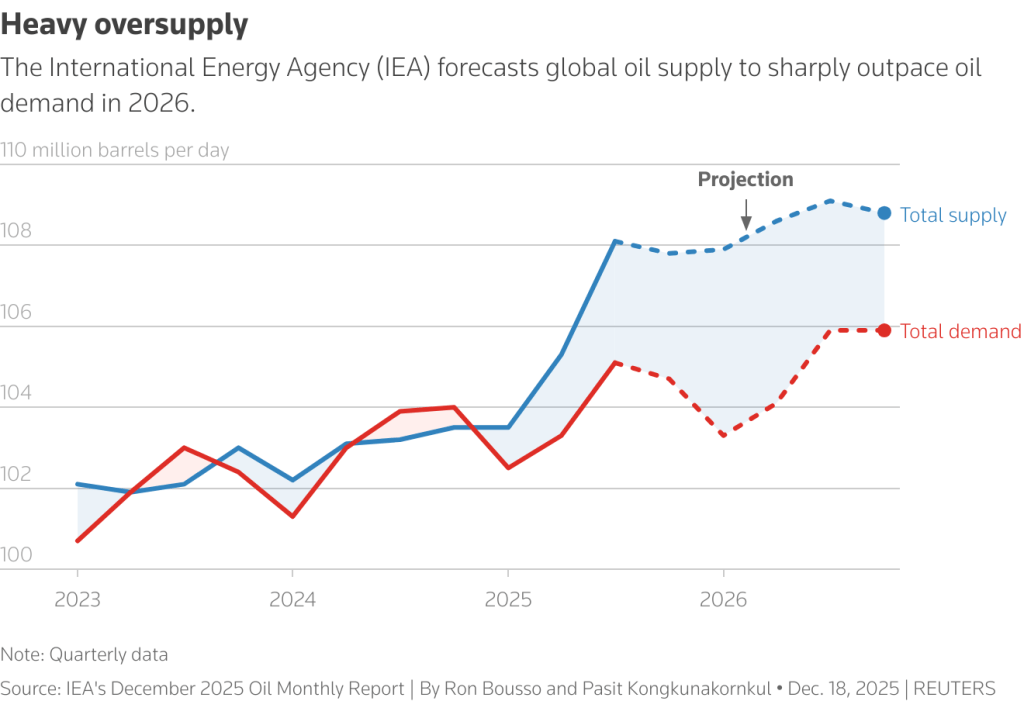

Third, in parallel, the study explains presently favorable oil market conditions consisting of a persistent supply glut, making any major cutoff of Russian seaborne oil exports feasible without sparking a lasting spike in world prices. I show how the OPEC-Gulf states, especially the Saudis and UAE, have facilitated this glut in coordination with President Trump et al, with the prospect of regaining much of the Indian and Chinese market discounted Russian oil has taken since 2022.

For the longer term, however, in the conclusion to this report, it is shown how the return of Venezuelan barrels to the market (and perhaps Iranian barrels as well) are part of a comprehensive USA energy strategy to create market conditions enabling both persistent low prices and, if necessary, the permanent “Liquidation of the Russian Petrostate,” to end the Ukraine war and Moscow’s international significance-in-general.

This is all seen to be part-and-parcel of the Trump administrations detailed commitment – with significant bipartisan support – to exercise “USA Energy Dominance” as a pillar of USA geo-economic power and geostrategy.

I am available for interviews and speaking on this Report’s topic. Contact EIES or me directly.