I discussed with Artur Ciechanowicz (BizNesAlert.pl) how Chancellor Merz and Energy Minister Reiche refuse the one reform that can really boost German energy security: focusing on nuclear energy as France has, and Poland has begun to do. (Read below in English or in Polish) — Twice last week, Merz indicated willingness to work with Russia when the Ukraine war ends. For two decades before the war, working with Russia meant more Russian gas imports, building Nord Stream 1 & 2. Now Merz worries about dependence on USA LNG. However, the German model he continues, one of installing BOTH a full-scale, wildly complex renewables system, plus a full-scale natural-gas backup system, guarantees high-cost energy, deindustrialization and foreign energy dependence.(Polish at BizNesAlert.pl)

Amerykański ekspert: Niemcy znów myślą o gazie z Rosji

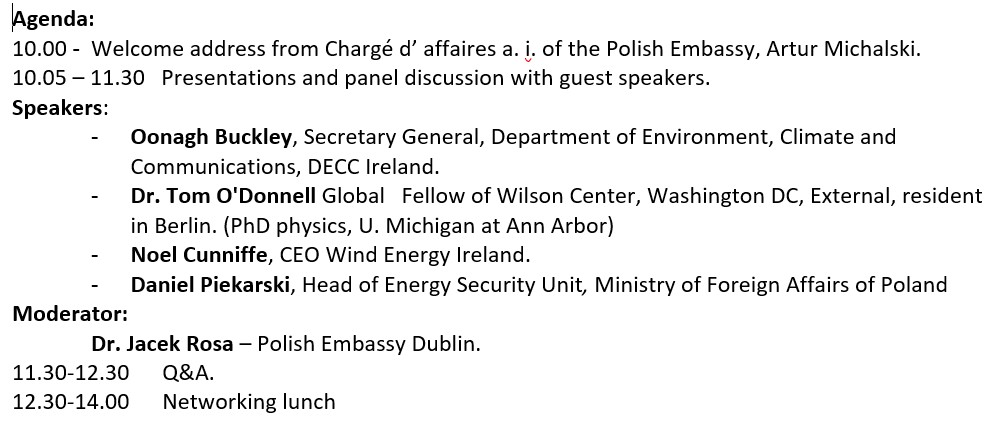

Autor: Artur Ciechanowicz27 stycznia, 2026, 07:05

Wcześniej czy później Niemcy ponownie będą racjonalizować podporządkowanie się Gazpromowi Putina w imię +dywersyfikacji+ dostaw – ocenia Thomas O’Donnell, ekspert ds. energii i geopolityki z amerykańskiego think-tanku Wilson Center. Na zdjęciu kanclerz Niemiec Friedrich Merz.FOTO: x.com/_FriedrichMerz

Berlin zaczyna zmieniać kurs wobec Rosji i znów będzie racjonalizować współpracę z Putinem w imię „dywersyfikacji” dostaw gazu. Stanie się tak, bo Niemcy nadal opierają swoją strategię energetyczną na OZE wspierane gazem, zamiast postawić na atom jako priorytet – ocenia w rozmowie z Biznes Alert amerykański ekspert Thomas O’Donnell.

Wypowiedzi kanclerza Niemiec Friedricha Merza o potrzebie „pojednania” z Rosją, wygłoszone dwukrotnie nie da się traktować, jako wyrwanych z kontekstu i przypadkowych. To sygnał polityczny. Najbogatsze państwo Europy i przemysłowy motor Unii Europejskiej zaczyna rewidować swoją linię wobec Moskwy.

Merz z ufnością o Rosji

– Jeśli uda nam się przywrócić pokój i wolność w Europie, jeśli ponownie odnajdziemy równowagę w relacjach z naszym największym europejskim sąsiadem, czyli z Rosją, jeśli zapanuje pokój i zostanie zapewniona wolność – jeśli to wszystko nam się powiedzie, wtedy Unia Europejska, a wraz z nią my w Niemczech, przejdziemy kolejny test i będziemy mogli z ufnością patrzeć w przyszłość także po 2026 roku – powiedział szef niemieckiego rządu na spotkaniu noworocznym z przedstawicielami przemysłu i handlu 14 stycznia w Halle, dodając potem: „(…) jeśli w dłuższej perspektywie uda nam się na nowo przywrócić równowagę w relacjach z Rosją, gdy zapanuje pokój i gdy wolność będzie zagwarantowana”.

Niemiecki przemysł od 2023 roku zmaga się z wysokimi cenami energii, spadkiem konkurencyjności, rosnącą presją chińskich producentów oraz stagnacją wzrostu gospodarczego. W 2024 roku niemiecka gospodarka formalnie weszła w recesję techniczną, a prognozy wzrostu na 2025 rok były jednymi z najsłabszych w UE.

Wypowiedzi Merza nie oznaczają natychmiastowego zwrotu w polityce wobec Moskwy ani propozycji zniesienia sankcji. Nie są ofertą pokoju ani jednostronnym gestem. Wskazują jednak na rosnące przekonanie w niemieckich elitach politycznych i gospodarczych, że obecny stan konfrontacji – bez realistycznej strategii wyjścia – osiągnął dla nich próg bólu.

„Powrót do „mafijnego bossa od gazu”

Thomas O’Donnell, ekspert ds. energii i geopolityki z amerykańskiego think-tanku Wilson Center wyjaśnia w rozmowie z Biznes Alertem intencje Merza: „Niemieckiemu kanclerzowi chodzi przede wszystkim o uniezależnienie się od pełnego sojuszu z USA, od zależności od Stanów Zjednoczonych. Jednak powrót do starego +mafijnego bossa od gazu+, Władimira Putina, trudno nazwać niezależną strategią”.

Z analizowanych przez O’Donnella wypowiedzi i komentarzy, a także z poufnych rozmów wynika, że niemieccy urzędnicy rządowi traktują amerykańską energię, jako potencjalnie równie zawodną jak tę z Rosji.

– Merz zlecił w związku z tym swoim ludziom znalezienie rozwiązań. Oczywiście, metody Donalda Trumpa w relacjach z sojusznikami nie są konstruktywne. Mimo że Niemcy są teraz ogromnym odbiorcą LNG z USA, to amerykański prezydent traktuje te biznesowe więzi również jako instrument nacisku – zaznacza ekspert.

– Jednak źródło problemu leży w nierealistycznej polityce energetycznej ostatnich czterech kanclerzy. Merz dostrzega problem silnie subsydiowanych odnawialnych źródeł energii oraz nadmiernej zależności od rosyjskiego gazu. Ale wciąż nie widzi, że Niemcy nie mogą zapewnić sobie bezpieczeństwa energetycznego ani przystępnych cen, opierając się na zależnych od pogody OZE wspieranych gazem. Postawienie na nową energetykę jądrową jako priorytet to jedyna droga — co Francja jasno udowodniła – dodaje.

Niemcy znowu pomyślą o gazie z Rosji

O’Donnell zwraca uwagę, że Merz i jego rząd popierają kontynuację budowy tych samych dwóch równoległych systemów, które tworzyli poprzedni dwaj kanclerze: jednego opartego wyłącznie na OZE i drugiego — gazowego — jako zaplecza na dni bez wiatru lub słońca.

– W praktyce tak zwana reforma polityki energetycznej Merza polega na tym, że dalsza rozbudowa OZE i sieci ma być teraz w większym zakresie finansowana z prywatnych środków, a planowane ogromne instalacje turbin gazowych również mają powstać — tyle że zasilane LNG z USA, a nie rosyjskim gazem – podkreśla Thomas O’Donnell i ocenia, że nie jest to radykalna, strukturalna reforma energetyczno‑przemysłowa, której Niemcy potrzebują, a jedynie kosmetyczna zmiana.

– W sposób konieczny wcześniej czy później doprowadzi to do tego, że Niemcy ponownie będą racjonalizować podporządkowanie się Gazpromowi Putina w imię +dywersyfikacji+ dostaw. Czy to z powodu ideologiczno‑technologiczno‑politycznego zamieszania, czy oportunizmu — niemieccy przywódcy nie dostrzegają, że już istniejące OZE i każda nowa generacja gazowa powinny być traktowane jedynie jako rozwiązania pomostowe, podczas gdy rozwój energetyki jądrowej powinien być priorytetem – jako jedyna realna droga – podsumowuje amerykański ekspert.

Artur Ciechanowicz

American expert: Germany is considering gas from Russia again

Author: Artur Ciechanowicz January 27, 2026, 07:05

Sooner or later, Germany will once again rationalize its subordination to Putin’s Gazprom in the name of “diversification” of supplies, says Thomas O’Donnell, an energy and geopolitics expert at the American think tank Wilson Center. Pictured is German Chancellor Friedrich Merz. PHOTO: x.com/_FriedrichMerz

Berlin is beginning to change course towards Russia and will once again rationalize cooperation with Putin in the name of “diversifying” gas supplies. This will happen because Germany continues to base its energy strategy on renewable energy supported by gas, instead of prioritizing nuclear power, American expert Thomas O’Donnell told Biznes Alert.

German Chancellor Friedrich Merz’s statements about the need for “reconciliation” with Russia, made twice, cannot be dismissed as out of context or coincidental. They are a political signal. Europe’s richest country and the industrial engine of the European Union is beginning to reconsider its stance towards Moscow.

Merz with confidence about Russia

– If we manage to restore peace and freedom in Europe, if we manage to find balance again in relations with our largest European neighbor, Russia, if peace prevails and freedom is guaranteed – if all this succeeds, then the European Union, and with it we in Germany, will have passed another test and will be able to look to the future with confidence even after 2026 – said the head of the German government at a New Year’s meeting with representatives of industry and trade on January 14 in Halle, later adding: “(…) if in the long term we manage to restore balance again in relations with Russia, when peace prevails and freedom is guaranteed.”

German industry has been struggling with high energy prices, declining competitiveness, increasing pressure from Chinese manufacturers, and stagnant economic growth since 2023. In 2024, the German economy formally entered a technical recession, and growth forecasts for 2025 were among the weakest in the EU.

Merz’s statements do not signal an immediate shift in policy toward Moscow or a proposal to lift sanctions . They are not an offer of peace or a unilateral gesture. However, they indicate a growing conviction among German political and economic elites that the current state of confrontation—without a realistic exit strategy—has reached their pain threshold.

“Return to the ‘Mafia Gas Boss'”

Thomas O’Donnell, an energy and geopolitics expert from the American think-tank Wilson Center, explains Merz’s intentions in an interview with Biznes Alert: “The German chancellor is primarily concerned with becoming independent from a full alliance with the United States, from dependence on the United States. However, returning to the old ‘mafia gas boss’, Vladimir Putin, is hardly an independent strategy.”

Statements and comments analyzed by O’Donnell, as well as confidential conversations, indicate that German government officials view American energy as potentially as unreliable as that from Russia.

“Merz has therefore tasked his people with finding solutions. Of course, Donald Trump’s methods in relations with allies are not constructive. Even though Germany is now a huge recipient of LNG from the US, the American president also uses these business ties as a tool for pressure,” the expert notes.

“However, the root of the problem lies in the unrealistic energy policies of the last four chancellors. Merz recognizes the problem of heavily subsidized renewable energy sources and excessive dependence on Russian gas. But he still fails to see that Germany cannot ensure energy security and affordable prices by relying on weather-dependent renewable energy sources supported by gas. Prioritizing new nuclear energy is the only way forward—as France has clearly demonstrated,” he adds.

Germany will think about gas from Russia again

O’Donnell points out that Merz and his government support the continuation of the construction of the same two parallel systems that the previous two chancellors created: one based solely on renewable energy and the other – gas – as a backup for days without wind or sun.

– In practice, the so-called Merz energy policy reform means that further expansion of renewable energy sources and the grid is now to be financed to a greater extent from private funds, and the planned huge gas turbine installations are also to be built – but powered by LNG from the USA, not Russian gas – emphasizes Thomas O’Donnell, assessing that this is not the radical, structural energy and industrial reform that Germany needs, but merely a cosmetic change.

“Sooner or later, this will inevitably lead to Germany once again rationalizing its subordination to Putin’s Gazprom in the name of ‘diversification’ of supplies. Whether due to ideological, technological, and political confusion or opportunism, German leaders fail to recognize that existing renewable energy sources and any new gas-fired generation should be treated merely as bridge solutions, while the development of nuclear energy should be a priority—the only viable path,” the American expert concludes.

Artur Ciechanowicz