A Sinopec station in China. Sinopec and other big NOC’s are slashing prices to take business from Chna’s small private “Tea Pot” refiners.

Last week, I was quoted on my assessment of how China’s “Tea Pot” refineries (small, private outfits) will fare in the face of China’s big National Oil Companies (NOCs) cutting prices to grab the Tea Pots’ business. My main point to Newsbase reporter Saw Wright was that China is far from a completely “free market” and the state can be expected to weigh in on one side or another, complicating any outcome predictions based on market and/or tech strengths and weaknesses. I’m quoted a couple times near the article’s end, here:

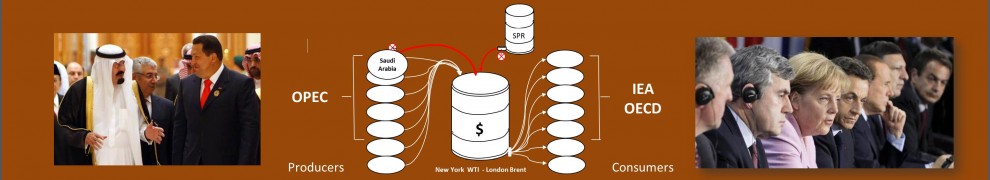

The developments with Tea Pots in China now have ramifications for the Global Barrel oil market in this time of oversupply and low prices driven especially by US shale’s constant productivity improvement and its continued high-level production, … all of which OPEC and non-OPEC (esp. Russia) producers — the so-called “Vienna Group” — are desperately trying to counteract.

Feedback is always welcome!