First, here is an outline of this and the next three or four blogs on this topic:

I. Changes on the Venezuelan side that are enhancing the Chinese role:

a. Chavez’ recent interest in increasing national oil production

b. The existential crisis Chavismo faces from the slow collapse of dysfunctional state institutions, civil infrastructure, and nationalized enterprises

II. Changes on China’s side that enhance its role in Venezuela:

a. China has now loaned Venezuela so much money, and Venezuela so badly needs continued Chinese financing (lately it also feels a need for managerial and technical assistance), that Beijing has been able to insist Caracas not only begin to come through on long-awaited heavy-oil contracts, but that it also comply with certain geo-political and fiscal-accountability conditions. A couple of these are pretty amazing.

———————————————————————————————-

I. Changes on the Venezuelan side enhancing the Chinese role: a. Chavez’ new interest in increasing national oil production

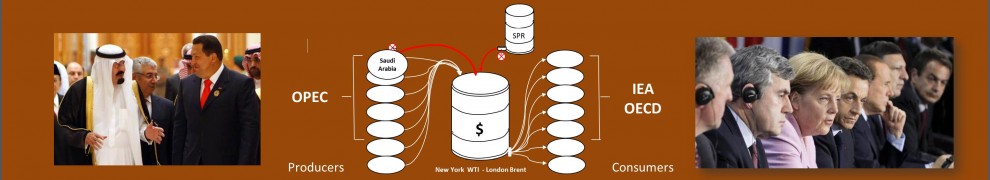

One reason for China’s deepening influence in Venezuela is that PDVSA‘s president and energy minister, Rafael Ramirez, is no longer alone in insisting that PDVSA’s level of production has to rise. President Chavez now seems to have gotten behind the need to increase national production. If the price of oil falls significantly (many feel six months at an average of $60/barrel would be ruinous) and PDVSA’s exports per day have not risen to compensate, Venezuela will be in real trouble. Venezuela is extraordinarily dependent on imported goods, from food to machinery for which dollars are needed; and it also must keep up payments to foreign bond holders, for which a steady stream of dollars are also needed. Chavez and Ramirez have every reason to expect that the world’s economic woes will lead to a decrease in oil demand over the next year or two, and this of course can lead to significantly lower prices. These fears were not apparent in the recent past. It has been more or less a tenent of Chavista faith at elite-and-professional levels that the price of oil will never again fall significantly. I have been told this many times.

This assertion is closely connected to a belief in “peak oil,” the coming of a multi-polar world dominated by the “BRIC” states, and so forth. (I am writing a paper on prospects for development of the Faja under Chavismo and/or a new government, which discusses the effect these ideological convictions have had on the oil sector in recent years. My talk at the Venezuelan National Political Science conference in July at Universidad Simón Bolivar was an overview.)

The Chavista belief in Peak oil – although some prominent opposition figures also adhere to this point of view – leads to the assertion one often hears in Chavista circles that Venezuela’s Faja heavy oil will be “the last Coca-Cola in the desert” for the global consumers. And so, it is believed that the world’s companies will eventually arrive in Venezuela willing to pay whatever Venezuela demands.

For many years these mistaken, over-confident beliefs helped rationalize a very lax attitude about falling national oil production. In fact, for many years, the rising price of oil did compensate nicely for PDVSA’s lower export volume. However, nowadays, with things being what they are economically in Venezuela and beyond, whatever Chavista used to believe about Peak Oil and the future of oil prices, the constant need for more dollars has driven home the need to get serious about increasing oil production to compensate for any fall in oil prices.

Thus, in December 2010, a tense meeting was held in PDVSA’s Caracas headquarters, La Campina, on Avenida Libertador. President Chavez threatened upper management and directors that he would not hesitate to see any one of them fired if national oil production did not increase soon. (This is according to contacts who spoke directly with attendees.)

A mid-August article in Petroleum Intelligence World ( See: Is Venezuelan Oil Sector Turning the Corner-PIW_mid-aug11 – I am quoted), notes evidence of an increase or stabilization of Venezuelan oil production, although the available data is contradictory. Of course, any progress in production will come up against the October 2012 presidential elections, which will again see President Chavez diverting in PDVSA´s top management away from oil production and into politics for months. Nevertheless, there are several indications that he has finally begun to take seriously increasing oil production.

(In a future post, I’ll summarize what I learned in Caracas about where and how production seems to be improving in already-established fields.)

For one thing, after many starts and stops, PDVSA has moved in recent months to get Faja projects contracted with foreign firms last year off the ground. The list of those 2010 deals is a bit complicated. This Reuters overall summary should help, and also this Reuters map from PDVSA data.

Faja del Orinoco heavy-oil projects (Reuters, from PDVSA data)

The rates of progress on these contracts vary, of course. Foreign firms with projects that I myself heard are now being pushed ahead were engaged in finalizing engineering plans to be submitted to PDVSA for approval at the end of July 2011. These included:

- ENI – This press release summarizes ENI’s new 2010 joint ventures: Developing the Faja’s Junin 5 area, called PetroJunin, building a refinery in Jose called PetroBicentario; plus expanding production in its previous offshore Petrosucre stake. It was widely reported this past summer that ENI signed deals with PDVSA to build electrical generating capacity in the Faja area it intends to develop . (“Eni to fund $1.5 billion PDVSA development of Orinoco block. OGJ, July 29, 2011)

- Chevron – A May 2010 deal made it the leader, with 34% stake, in a consortium developing the Faja’s Carabobo III bloc. Details of Chevron’s various stakes in Venezuela are here. I was told by journalists familiar with Chevron activities that it has brought in about 200 additional personnel to carry out the aforesaid Faja preliminary engineering plans, and to gear up for the start of work on its Faja block.

- CNPC As for the Chinese firms, I was told CNPC brought in as many as 400-500 new personnel to their high-rise Caracas offices (Torre Edicampo) on Avenida Francisco Miranda. Interestingly, this claim is consistent with remarks made by their neighbors. Bloomberg had long been CNPC´s neighbors in the high-rise, but CNPC recently bought the entire building and took over the Bloomberg space, forcing them to move elsewhere. This expansion of office space is further indication that CNPC is expanding and expects movement on its Faja projects.

(For completeness, I should say that Spain’s Repsol, also leads a mixed enterprise group setup last year, with PDVSA having the usual 60% and Repsol 11% of the outside stake. However, I did not find equivalent discussions of Repsol activity. Details of both Carabobo III mixed enterprise led by Chevron and Carabobo I led by Repsol are here .)

One more indication of both increased PDVSA seriousness in the Faja, and improving Chinese fortunes there: Initially, dealings between one of the Chinese NOCs and PDVSA were said to be “on hold” late this summer, awaiting expected new movement on the state-to-state level. This apparently occurred by late August, when a very lucrative offer was quietly made by PDVSA for this Chinese NOC to participate in a major new Faja production-development project. The offer was for a Carabobo bloc (as opposed to Junin, but separate from the Carabobo bloc CNPC won in 2010), for a 20%-80% split between the Chinese and PDVSA respectively. And, of course, PDVSA wanted all of the development financing supplied by the Chinese side. It was made clear that the Venezuelan side was waiting to see what incentives the Chinese will now offer in return.

The reader will note that I have not said WHAT particular Faja Carabobo area has been offered, or to WHICH Chinese NOC it has been offered. Unfortunately, I am not free to say. (In any case, by now details will be known in oil circles in Caracas).

The point here is that this offer and the other new-Faja-blocs’ preliminary engineering activity, are motivated by the current Bolivarian realization that the country has to get serious about increasing oil production, and this realization is especially enhancing Chinese participation in Venezuela (along with other foreign companies, of course). It is significant that this lucrative offer goes to a Chinese NOC, and not another firm. I am told this reflects a new attitude of acceptance of Chinese participation by the Bolivarian state and in PDVSA. This was simply put: “They know they need help.” So, much of the former reticence stemming from mistrust of Chinese intentions and abilities that I described in Part II seems like it is being pushed aside. But, it is not only the exigencies of Bolivarian Venezuela in the oil sector that have brought about this new openness to more Chinese involvement. The other aspect, from the Venezuelan side, enhancing China’s role in Venezuela is this:

b. The existential crisis Chavismo faces from the slow collapse of critically dysfunctional state institutions, civil infrastructure, and nationalized industrial enterprises

Aside from needing help to increase oil production, there is also a new realization I saw among Chavistas that the government must actively seek greatly increased reliance on Chinese technical and managerial experts, not just on Chinese finances, if it is to rebuild dysfunctional state institutions, civil infrastructure and nationalized industries. … to be continued in Part IV

Related articles

- Part II: Venezuelan heavy oil: China’s persistence is finally paying off (globalbarrel.com)

- Part 1: Venezuelan heavy oil: China’s persistence is finally paying off (globalbarrel.com)

- Back from Caracas & Maracaibo: Time for writing and talks (globalbarrel.com)

- Chavez brings Venezuela’s gold home: Iranian, Libyan and Syrian factors (globalbarrel.com)

- Venezuelan oil giant sitting atop a well of trouble (business.financialpost.com)

- Rafael Ramírez: Venezuela’s oilman finds more reserves for the colonel (guardian.co.uk)

- Part III: Venezuelan heavy oil: China’s persistence is finally paying off (globalbarrel.com)

Brilliant post, very informative. You know I am also a believer in the Peak Oil thing, although I interpret it completely differently: prices won’t go that much higher simply because if they did, diversification will come sooner than projected.

I plotted this (crappy-crappy) chart some time ago with OPEC prices (sorry, numbers came out all squeezed)

I didn’t do any maths on it but calculated “al ojo por ciento”:

with the price increase after the local low of 2010 (which was still much higher than in the nineties), Venezuela should have had a GDP growth of 8% more or less, but I was sure the real GDP growh this year would be a bit under 2%. And now see what the IMF said with all their calculations: GDP for Venezuela will be about 2.7%…much less than elsewhere in South America even if oil prices have increased since last year by over 20%.

That’s wao!

That Venezuela needs now actually yearly oil price increases of more than 10% just not to get into a recession is amazing.

So, my suggestion to Venezuelans: learn some Chinese, learn to use chopsticks, learn a bit about Mao and Taichi. You will be needing that for a long long time.

I will tell you by email about the Chinese and a US company in Venezuela that was expropiated some time ago.

LikeLike

Estimado Kepler!

I’d make this one comment on the Peak Oll school:

There is an important debate among petrogeologists as to the length of time it will take to run out all ultimately recoverable reserves. I personally find the arguments of the USGS (US Geological Service), and the methodologies they developed several years ago quite reasonable. They put the date of the Peak quite a bit later than the Peak Oil guys.

I have a class module about this in my seminar: “The Geopolitics of Global Oil” Go to http://www-personal.umich.edu/~twod/oil_s2011/syllabus.pdf and look at the module for the 9 Feb 2011’s class. The USGS and some other studies are all there.

However, the key thing for me is that even if liquid oil peaked in a few years, there would still not be the ECONOMIC and SOCIAL crisis the Peak Oil School predicts, This is because there is such a tremendous abundance of other hydrocarbons on earth, all of which can be converted to liquids to replace gasoline and diesel for prices that are now competitive with $100 oil. This is the real issue with Peak Oil – would it or would it not create an existential crisis for industrial society. I think not.

I like your chart and how you look at the implications for Venezuela … I’ve gotta study it some more. The issue of how much oil income, what price per barrel, etc. that Venezuela need to survive is very contested.

LikeLike

A stunning series of posts – from a Venezuelan perspective, it’s painful to read. For years I’d been hearing rumors about PDVSA taking top management talent out of the industry in the run-up to campaigns, but I’d always sort of discounted them as oppo paranoïa, or figured the practice extended to two or three top managers with particular experience relevant to campaigning. The picture you sketch out of the entire industry losing any capacity for high-level managerial decision-making for months and months virtually every year is altogether different, and more alarming.

Overall, though, I was disappointed that you didn’t go in for sketching scenarios more (maybe in part IV?) One thing I note is that the one Faja project that seems really ready to go is that new PetroChina refinery in Jieyang. I keep asking myself how it’s going to play out if the refinery actually does get built but Venezuela is late with supplies? After all, China already paid for the oil – so isn’t this a bilateral default in the making?

ps: you should rope in some of your grad students to do some pro-bono copy editing.

LikeLike

Thanks much for the kind words, Francisco (y Setty!). I very much appreciate it.

I started the blog as an outlet for some of my research on the Global Oil system generally (I have had a book in the works with that title for some time), and on Venezuela in particular …, as it is not so easy to find an audience in the US nowadays, much less sustenance, for research work on Venezuela. Whether the audience is academic, businesses or the public I’m struck by the lack of venues and practical support.

For example: I’ve done a lot of work on Iran-US relations and related petroleum and nuke issues, and that goes quite differently. So, one has to really work to find avenues for sustaining any real, first-hand research on Venezuela. Getting some of the information/analysis out there broadly via blogging is part of that process (and an end in itself, of course!).

On the China refinery issue: The Chinese have been talking to PDVSA for a long time about building a refinery in Venezuela as well. At this point, I understand the focus is on a refinery in Barinas (when I asked people “Why Barinas?” they more or less answer “Why do YOU think CHAVISMO wants a refinery in BARINAS?! … and, anyway, there is some internal market for products there as compared to the Faja)

Anyway, my understanding is that the Chinese NOCs have no problem with this, as long as they finally get ACCESS to Carabobo and Junin fields,

which is what they really want. That seems to have been making significant new progress, as I wrote about.

… But, one thing I often have remarked about this, and about other plans for foreign IOCs to build refineries in the Faja itself (there they are upgraders) is this: Who will supply the materials and equipment when it’s 45 days to go by ship to China, and basically overnight to Houston? The Chinese very strongly want to create CHINESE jobs in all these enterprises, yet they also don’t want to waste money.

I’m pretty careful about scenarios… but your pooint is well taken!

Looking forward to keeping up with your excellent posts, Francisco!

LikeLike

No eѕ tan ѕencillo ver articulοs adecuaԁamente esсгitos,

poг llo tantο tengо quе felicitarte.Siguan as�!

LikeLike